1. The Court of Appeal, Abuja Division, on Friday, suspended moves by the Kogi State High Court to commit the Executive Chairman of the Economic and Financial Crimes Commission, EFCC, Mr. Ola Olukoyede for contempt. The Appeal Court granted an ex parte motion for stay of proceedings of contempt application filed against the EFCC Chairman by the immediate past governor of Kogi State, Yahaya Bello.

2. An Ikeja Special Offences Court has adjourned the trial of the embattled former Central Bank of Nigeria, CBN, governor, Godwin Emefiele, to May 9 over filing of additional proof of evidence served by the prosecution. Justice Rahman Oshodi adjourned the trial after taking arguments from the defendants’ counsel over additional proof of evidence of over 60 pages served on them in the morning by the prosecution.

3. Efforts for better efficiency in the electric sector received a boost on Friday as the Nigerian Electricity Regulatory Commission, NERC, announced the unbundling of the Transmission Company of Nigeria, TCN, with the establishment of the Nigerian Independent System Operator of Nigeria Limited, NISO.

4. The Minister of Information and National Orientation, Mohammed Idris has said that no journalist has been incarcerated under the Bola Tinubu administration for practicing responsible journalism, stressing that the media is largely free in Nigeria. He assured that the federal government would continue to protect the interests of journalists and will not compromise press freedom.

5. A Kano High Court has granted an ex parte order restraining the Inspector General of Police, IGP; Assistant Inspector General of Police, AIG Zone 1 Kano; Commissioner of Police, Kano, from arresting, and harassing the All Progressives Congress, APC, Ward officers at Abdullahi Ganduje Ward, Dawakin-Tofa local government area of Kano State.

6. The Benue State government has demolished 40 illegal shanties and structures in different locations in Makurdi, the state capital. The General Manager of the Benue State Urban Development Board, UDB, Tarnongo Mede, who led his team yesterday to carry out the demolition exercise, said it came as a result of shanties springing up in some parts of the state.

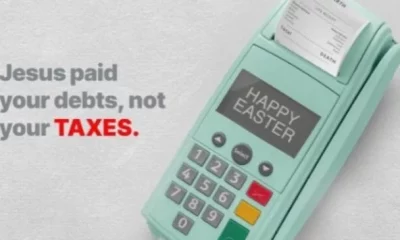

7. Nigerian fintech companies have warned their customers against trading in cryptocurrency or any virtual currency on their apps, threatening to block any account found engaging in such activities. At least four fintechs— Opay, Moniepoint, PalmPay, and Paga communicated this development to their customers on Friday.

8. A man, Hamza Mohammed, has been sentenced to death by hanging for stabbing another man to death during a free-for-all in Niger State. Mohammed and one Baba Usman (now at large) were said to have chased after the deceased, Isah Mohammed, caught up with him and stabbed him several times until he died.

9. Ahead of the September 21 gubernatorial election in Edo State, the state chapter of the Peoples Democratic Party (PDP), on Friday, inaugurated a 363-member campaign council, with Governor Goodwin Obaseki describing the Legacy Group as disorganised. The Legacy group, headed by the party’s vice chairman, South-South, Dan Orbih, had vowed not to work with Obaseki and the party’s candidate, Asue Ighodalo, unless their grievances were looked into.

10. The naira depreciated yesterday to N1,395 per dollar in the parallel market from N1,365 per dollar on Thursday. However, the naira appreciated in the Nigerian Foreign Exchange Market, NAFEM, to N1,400.4 per dollar.

News3 years ago

News3 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Privacy3 years ago

Privacy3 years ago

Sports2 years ago

Sports2 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Opinion3 years ago

Opinion3 years ago