President Muhammadu Buhari has reversed his earlier decision to authorise Seplat Energy’s takeover of ExxonMobil’s shallow water business in Nigeria, throwing his weight instead behind the regulator’s decline of the $1.3 billion transaction.

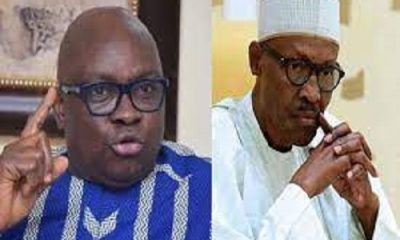

A spokesperson said the president decided the position of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) is to be supported, and the earlier confusion was because “various agencies involved in (the) decision had not coordinated well among themselves.”

“It has become clear that the various agencies involved in decision had not coordinated well among themselves and having looked at all of the facts with all of the ramifications, the president decided the position of the regulator is to be supported,” spokesperson Garba Shehu told PREMIUM TIMES Wednesday evening in response to persistent enquiry by one of our reporters.

The NUPRC had on Monday said the proposed takeover of Mobil Producing Nigeria Unlimited by Seplat, an indigenous oil firm, was a regulatory matter and it had notified ExxonMobil the transaction could not go through.

“As it were, the issue at stake is purely a regulatory matter and the Commission had earlier communicated the decline of Ministerial assent to ExxonMobil in this regard. As such the Commission further affirms that the status quo remains,” said a statement by NUPRC chief executive, Gbenga Komolafe.

“The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) affirms that status quo remains in respect of ExxonMobil/Seplat Energy share acquisition. Responding to media enquiries on latest development about the transaction, the Chief Executive of the NUPRC Engr. Gbenga Komolafe clarified that the Commission in line with the provisions of the Petroleum Industry Act 2021 is the sole regulator in dealing with such matters in the Nigerian upstream sector.

The statement came a few hours after presidential spokesperson Femi Adesina said Mr Buhari had approved the sale to Seplat.

Mr Adesina said Mr Buhari approved the transfer in his capacity as Minister of Petroleum Resources and the approval was in consonance with the country’s drive for Foreign Direct Investment in the energy sector and considering the “extensive benefits of the transaction to the Nigerian Energy sector and the larger economy.”

THE SEPLAT SALE DEAL

ExxonMobil entered into a landmark Sale and Purchase Agreement with Seplat Energy to acquire the entire share capital of Mobil Producing Nigeria Unlimited from Exxon Mobil Corporation, Mobil Development Nigeria Inc, and Mobil Exploration Nigeria Inc. earlier this year.

The transaction suffered a setback after the state-owned Nigerian National Petroleum Corporation Limited asserted a right of first refusal on the deal. As a joint venture partner, NNPC argued it retained the right to be allowed to buy oil blocks sold by ExxonMobil ahead of any competitor or private firm.

Seplat Energy in July said NNPC Ltd. won a court decision to block its quest to purchase the entire oil assets of Mobil Producing Nigeria Unlimited (MPNU), a local unit of oil major ExxonMobil.

The court decision on July 6 was temporary and forbade MPNU and the defendants from consummating any asset disposal in MPNU, not excluding the share sale and purchase deal it struck with Seplat in February.

NNPC had prayed the court, State High Court of the Federal Capital Territory, to declare that a conflict happened between the state-owned oil company and MPNU over the “interpretation of preemption rights under their Joint Operating Agreement (“JOA”) and order NNPC and MPNU to arbitration as required by the JOA.”

Seplat Energy said neither itself nor Seplat Energy Offshore Limited was a party in the lawsuit, and insisted the share purchase agreement remained valid. The asset purchase would enable Seplat Energy to scale up production by 95,000 barrels of oil a day from assets in a joint venture ExxonMobil runs with NNPC.

Buhari had last week declined Seplat’s bid in favour of NNPC, only for a contradictory statement to be released on Monday. Officials said the contradictory decisions suggest the president may not be in full control of critical state matters and powerful interests sometimes work through aides to obtain favourable, even if controversial, decisions.

They questioned why the president would hand the oil asset to a private firm when the government has just recently commercialised the NNPC, making the former regulator a operator and competitor in the industry.

ExxonMobil’s move to exit Africa’s largest crude producer mirrors the growing tendency among international oil companies to discontinue their stakes in offshore operations in the country and plough in their investment elsewhere.

Oil drillers are finding operations that are close to host communities increasingly worrisome and feel holding on to offshore fields is the way to go.

In April, TotalEnergies SE announced plans to divest its 10 per cent minority stake in a joint venture with a company holding twenty onshore and shallow water licenses in Nigeria.

Shell, owner of the permits, has received approaches from four indigenous companies including Seplat for a 30 per cent stake in the firm.

News3 years ago

News3 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Privacy3 years ago

Privacy3 years ago

Sports2 years ago

Sports2 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Opinion3 years ago

Opinion3 years ago