The Federal Government has accused Binance of blackmail after the company alleged officials demanded $150 million in cryptocurrency payments as a bribe to settle the prosecution of its executives in Nigeria.

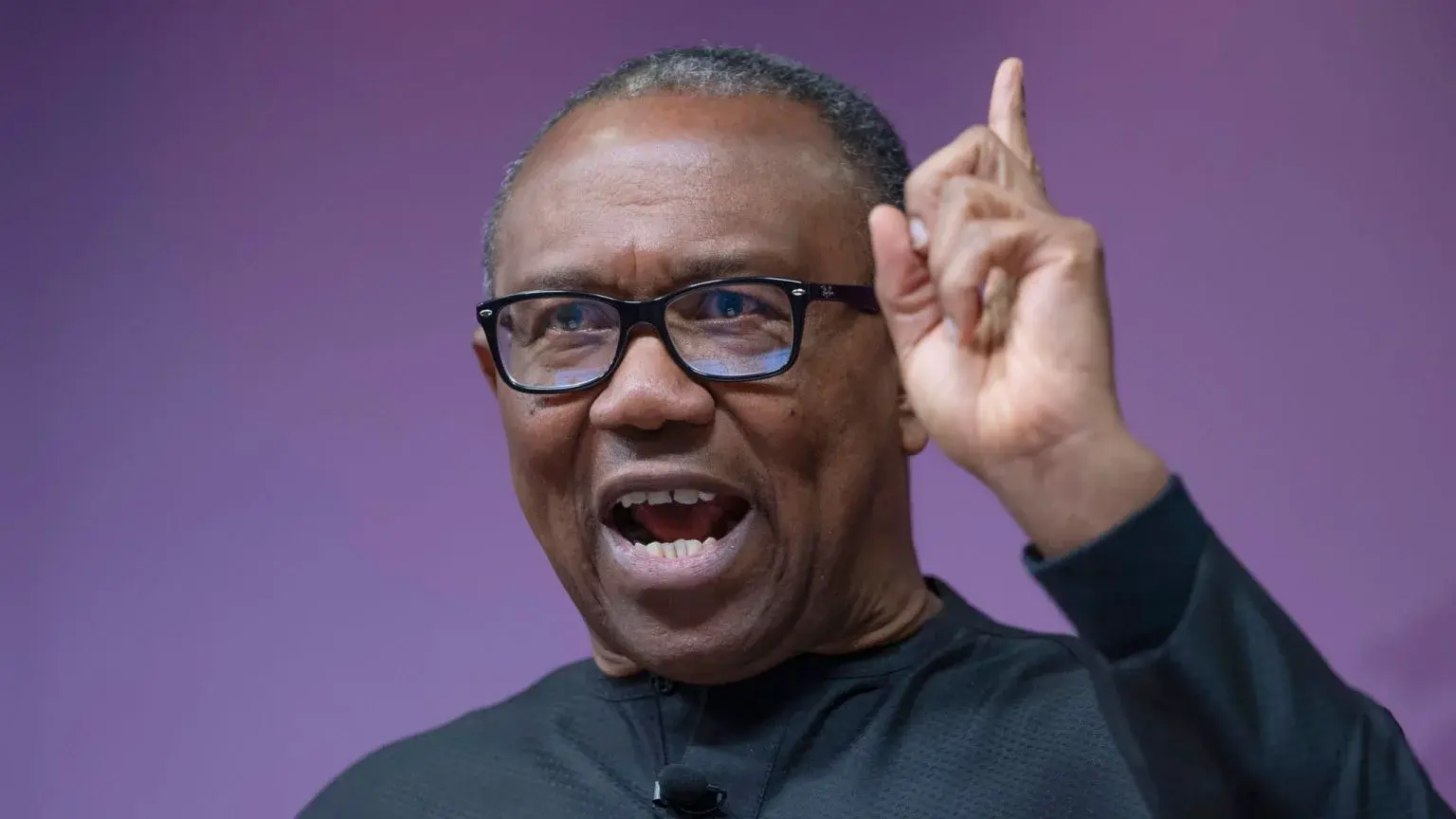

On Tuesday, Richard Teng, Binance’s chief executive officer (CEO), said some unknown persons in Nigeria demanded huge payments in digital currency to make their problems in the country “go away”.

Teng’s allegation followed the detention of Nadeem Anjarwalla, Binance’s regional manager for Africa, and Tigran Gambaryan, the company’s head of financial crime compliance, in Nigeria, on February 28.

The two executives were detained as part of a probe bordering on Binance’s illegal operations in Nigeria and foreign exchange rate manipulations.

While criminal charges have been against Binance and Gambaryan, Anjarwalla fled detention on March 22.

However, Anjarwalla was reportedly arrested by the Police Service in April and the International Criminal Police Organisation (Interpol) is working towards extraditing him to Nigeria.

In a statement by Rabiu Ibrahim, special assistant to the minister of information and national orientation, the government said the allegation by Binance is an attempt by the cryptocurrency exchange to launder its impaired image as an organisation that does not play by the rules and laws guiding business conduct in sovereign nations.

“In a blog post that has now been published by many international media organisations, in an apparent well-coordinated public relations effort, Binance Chief Executive Officer Richard Teng made false allegations of bribery against unidentified Nigerian government officials who he claimed demanded $150m in cryptocurrency payments to resolve the ongoing criminal investigation against the company,” the ministry said.

“This claim by Binance CEO lacks any iota of substance. It is nothing but a diversionary tactic and an attempted act of blackmail by a company desperate to obfuscate the grievous criminal charges it is facing in Nigeria.

“The facts of this matter remain that Binance is being investigated in Nigeria for allowing its platform to be used for money laundering, terrorism financing, and foreign exchange manipulation through illegal trading.

“While this lawful investigation was going on, an executive of Binance, who was in court-sanctioned protective custody, escaped from Nigeria, and he is now a fugitive from the law. Working with the security agencies in Nigeria, Interpol is currently executing an international arrest warrant on the said fugitive.”

BRIBERY ALLEGATION PART OF ORCHESTRATED INTERNATIONAL CAMPAIGN

The ministry said the bribery allegation is part of an orchestrated international campaign by Binance to undermine the Nigerian government.

The ministry said Binance is facing criminal prosecution in many countries including the United States.

“Just a week ago, the founder and former CEO of Binance, Changpeng Zhao, was sentenced to prison in the United States, after pleading guilty to charges very similar to what Binance is being investigated for in Nigeria. In addition, Zhao agreed to pay a fine of $50 million, while Binance is liable for $4.3 billion in fines and forfeitures to the US Government,” the government said.

“We would like to remind Binance that it will not clear its name in Nigeria by resorting to fictional claims and mudslinging media campaigns. The only way to resolve its issues will be by submitting itself to unobstructed investigation and judicial due process.”

The ministry said the Nigerian government will continue to act within its laws and international norms and will not succumb to any form of blackmail from any entity, local or foreign.

News3 years ago

News3 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Privacy3 years ago

Privacy3 years ago

Sports2 years ago

Sports2 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Opinion3 years ago

Opinion3 years ago