As part of the measures to tackle incessant power outages in the country, President Bola Tinubu has approved the gradual payments of power sector debts estimated at over N3.3tn.

Consequently, about N1.3tn owed power generating companies by the Federal Government will be paid via cash injections and promissory notes, while about $1.3bn (N1.994tn using the current official closing rate) owed to gas companies will be paid via cash and future royalties.

Already, the Federal Government has commenced payment of the cash part of the N1.3tn debt owed Gencos and concluded plans to settle the second part via promissory notes within a timeframe ranging from two to five years.

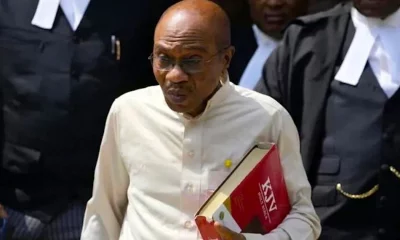

The Minister of Power, Chief Adebayo Adelabu, disclosed this at the 8th Africa Energy Marketplace held on Thursday in Abuja.

The event was themed, “Towards Nigeria ‘s Sustainable Energy Future: Policy, Regulation and Investment – A Policy Dialogue for the National Integrated Electricity Policy and Strategic Implementation Plan.”

The government is subsidising electricity by shouldering the gas payment component for power generation.

But over the years this payment has not been steady, leading to humongous gas debts as well as indebtedness to power generation companies.

Disclosing the solution to the issue, Adelabu stated that Tinubu had directed the Minister of Finance to make immediate payment of N130bn from the Gas Stabilisation Fund, being part of the N1.3tn owed Gencos. The rest will be spread over some time.

The power minister further explained that the payment of $1.3bn legacy debts owed gas producers would be sourced from future royalties and income streams in the gas sub-sector, a solution deemed satisfactory by the gas-supplying companies.

He said, “It is true that I mentioned that Mr President has approved the submission of the Hon. Minister of State Petroleum (Gas) to defray the outstanding debts owed to the gas supplying companies to the power sector operators.

“The payments will be in parts. We have the legacy debt and we have the current debt. For the current debt, approval has been given for a cash payment of about N130bn from the Gas Stabilisation Fund, which the Federal Ministry of Finance will pay, if not already paid.

“The payment for the legacy debts is going to be made from future royalties and streams of income in the gas sub-sector which is quite satisfactory to the gas supply companies. The last amount that was being quoted was $1.3bn, which we believe will go a long way to encourage these gas companies to enter into firm supplying contracts with the power generating companies.”

He further explained, “The situation we are in now is on a best endeavour model, which means there is no firm contract between the gas companies and the majority of the power generating companies. The day they can supply gas, they will, the day they cannot supply gas, there is no penalty. But once there is a firm contract they will be under contractual obligations to supply gas to these power-generating companies so that we can have a consistent power generation.

“So, that is the situation and the model we want to adopt for the gas segment of the power sector value chain.”

Continuing, the minister voiced concerns about the lack of policy coordination in the power sector, assuring the sector however that the current administration was committed to eliminating all bottlenecks in the industry.

Adelabu also justified the Band A tariff hike, saying that only 15 per cent of Nigerians were affected.

He disclosed that without proper billing, the power reform agenda of the present administration might not be achieved.

The minister also revealed that with the generation of 700MW from the Zungeru hydroelectric power plant, the Nigerian Electricity Supply Industry has recorded a new feat of 5,000MW.

Regarding the power-generating companies, he noted that the president had approved cash injections and promissory notes, providing significant encouragement to the companies and incentivising them to further invest in generation capacity.

The minister explained, “For the power generating companies, the debt is put at N1.3tn. I can also tell you that we have the consent of Mr. President to pay on the condition of settling the reconciliation of these debts between the government and the power-generating companies.

“And this, we have successfully done, and it is being signed off by both parties now. The majority have signed off, and we are engaging others to ensure we have a 100 per cent sign-off from the power-generating companies. And the modalities for paying this will be in two ways. Of course, there will be a cash injection, immediate cash injection.”

He added, “Government is not buoyant enough to pay down N1.3tn once and for all in terms of cash. But there is a fraction of it that will be paid in cash while the remaining fraction will be settled through a guaranteed debt instrument, preferably a promissory note.

“That is more like a comfort to these companies that in the next two, three to five years, the government is ready to defray this debt finally. This will go a long way to encourage the power generating companies to incentivise them to even invest more in generation so that you can know our generating output from the level it is now to a higher level because as I mentioned, there is an opportunity for demand locally and across the border. And that is a source of foreign exchange earnings for the country.”

Adelabu, who said the supply of electricity had increased due to the implementation of the Electricity Act 2023 and the Band A tariff, added that the Discos were requesting more load for onward distribution to their customers.

The power minister had stated in February that Nigeria must begin to move towards a cost-effective tariff model, as he revealed that the country was indebted to the tune of N1.3tn to electricity generating companies, while the debt to gas companies was $1.3bn at the time.

News3 years ago

News3 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Privacy3 years ago

Privacy3 years ago

Sports2 years ago

Sports2 years ago

Entertainment2 years ago

Entertainment2 years ago

Opinion3 years ago

Opinion3 years ago

News3 years ago

News3 years ago