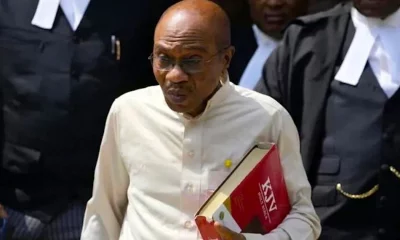

President Bola Tinubu has insisted that his administration’s decision to remove the petrol subsidy was very necessary to prevent the country from going bankrupt.

Tinubu announced the removal of subsidy on petrol the day he was inaugurated into office with the popular “subsidy is gone” speech.

The action, however, made prices of commodities to rise through the roof, increasing hardship in the country which has made some of his critics condemn the subsidy removal as a policy not well thought out.

But speaking as one of the panelists at the ongoing World Economic Forum in Riyadh, Saudi Arabia this morning, Tinubu justified the petrol subsidy removal, maintaining that it was needed to reset the economy.

“For Nigeria, we are immensely consistent with belief that the economic collaboration and inclusiveness is necessary to engender stability in the rest of the world.

“Concerning the question of the subsidy removal, there is no doubt that it was a necessary action for my country not to go bankrupt, to reset the economy and pathway to growth,” Tinubu said.

The Nigerian leader admitted the difficulty associated with his decision to jettison the policy which has allowed Nigerians to purchase petrol at cheaper rates for years but said that he was convinced it was in the best interest of the people.

“It is going to be difficult, but the hallmark of leadership is taking difficult decision at the time it ought to be taken decisively. That was necessary for the country. Yes, there will be blowback, there is expectation that the difficulty in it will be felt by greater number of the people, but once I believe it is their interest that is the focus of the government, it is easier to manage and explain the difficulties.

“Along the line, there is a parallel arrangement to really cushion the effect of the subsidy removal on the vulnerable population of the country. We share the pain across board, we cannot but include those who are vulnerable.

“Luckily, we have a very vibrant youthful population interested in discoveries by themselves and they are highly ready for technology, good education committed to growth. We are able to manage that and partition the economic drawback and the fallout of subsidy removal.”

Tinubu said that the petrol subsidy removal equally engendered accountability, transparency and physical discipline for the country. According to him, that is more important to focus on what direction the country should go.

Currency management equally necessary

Tinubu’s petrol subsidy removal was quickly followed by another critical policy, the exchange rate unification, which the president equally defended during the panel session of the WEF in Riyadh.

He said that the management of the nation’s currency by the government was as well necessary to allow the Naira compete favourably with other world currencies.

“The currency management was necessary equally to remove the artificial elements of value in our currency. Let our local currency find its level and compete with the rest of the world currency and remove arbitrage, corruption and opaqueness.

“That we did at the same time. That is two engine problem in a very template situation for the government, but we are able to manage that turbulence because we are prepared for inclusivity in governance and rapid communication with the public to really see what is necessary and what you must do.”

The World Economic Forum meeting focuses on Global Collaboration, Growth and Energy for Development.

News3 years ago

News3 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Privacy3 years ago

Privacy3 years ago

Sports2 years ago

Sports2 years ago

Entertainment2 years ago

Entertainment2 years ago

News3 years ago

News3 years ago

Opinion3 years ago

Opinion3 years ago