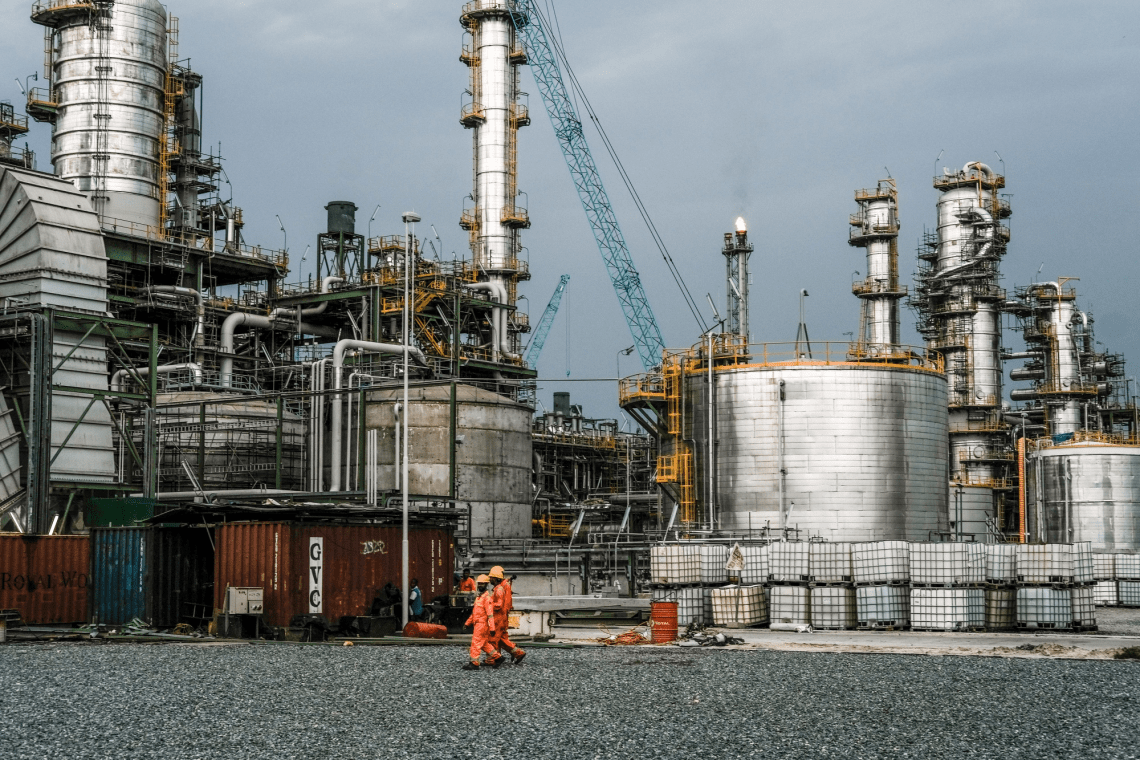

The Federal Government is set to deliver up to 400,000 barrels of Nigerian crude oil daily to the Dangote refinery under its naira-for-crude agreement, a report by Bloomberg stated on Monday.

It said this significant development is expected to take place over the next two months, amounting to 24 million barrels of Nigerian supply between October and November 2024.

This increase in processing capacity could have substantial implications for both the refinery’s operations and the local oil industry, transforming the region’s import and export markets.

This new development follows the announcement by the Federal Government that the naira-for-crude deal has commenced.

It would be recalled that the Nigerian National Petroleum Company Limited is set to begin the supply of crude oil in naira to the Dangote Petroleum Refinery this week with three more refineries set to start the production of Premium Motor Spirit.

According to cargo allocations reviewed by Bloomberg News, Dangote’s increasing reliance on local feedstock will disrupt the Atlantic oil market by substantially decreasing Nigeria’s crude exports.

The 650,000-barrel-a-day plant — larger than any other in Africa or Europe — will claim 13 to 14 shipments from Nigeria’s typical monthly program of about 50 cargoes.

The West African crude market is set to be “substantially tighter” in the fourth quarter because of the supply to Dangote, said Ronan Hodgson, a London-based analyst at FGE.

The volumes could even send Nigerian exports below 1 million barrels a day, he said.

Some shipments over the next two months may not be delivered as planned, and October’s list includes two cargoes already delayed from September.

Still, the scheduled volume is significantly larger than the average 255,000 barrels a day of Nigerian oil taken in by Dangote over the first half of the year as it gradually ramped up processing, data compiled by Bloomberg show.

Dangote is already running at 60-70 per cent capacity and will reach its full rate within months, project management firm Engineers India Ltd. Chairman Vartika Shukla said last month.

The latest allocations also suggest that Dangote has continued to curtail its buying of US crude, according to traders.

Earlier this year, the refinery imported millions of barrels of WTI Midland, before re-selling some of the oil and scrapping plans to buy more.

Nigerian National Petroleum Co. reached an agreement with Dangote last month under which the country’s state-owned energy firm will supply crude in return for being the sole distributor of the refinery’s crucial gasoline production.

If Dangote’s ramp-up continues to advance in the coming months, Nigeria could start to realize its long-held goal of curbing costly oil product imports.

“If the refinery runs at higher rates, the West African market for gasoline and diesel imports will shrink extremely quickly,” FGE’s Hodgson said.

News3 years ago

News3 years ago

Entertainment3 years ago

Entertainment3 years ago

Privacy3 years ago

Privacy3 years ago

News3 years ago

News3 years ago

Sports3 years ago

Sports3 years ago

Entertainment3 years ago

Entertainment3 years ago

News4 years ago

News4 years ago

Opinion3 years ago

Opinion3 years ago